Aircraft Finance Company - Buying an aircraft is less expensive than getting a private jet - at least up front. But additional costs like insurance and maintenance can sometimes cost you more than the aircraft itself. You can learn more about how financing works by visiting our guide to personal loans.

The 2022 Commercial Aircraft Finance Market Outlook shows commercial aviation required about $64 billion in delivery financing during 2021, up from $59 billion in 2020. Lessors shifted from negotiating lease deferrals to bidding for new business and the capital markets gave a vote of confidence by providing most

Aircraft Finance Company

issuers with pricing near pre-pandemic levels. Where there were shortfalls, export credit and institutional investors provided the necessary financing to support airlines. Supporting about 9% of funding for the industry and nearly 5% of Boeing deliveries in 2021, export credit-backed financing plays a crucial role to instill confidence in times of market dislocations.

Bottom Line

Boeing has agreements with export credit agencies around the world to bring the benefits of aviation and boost local economies. Aircraft are an attractive asset class and the pandemic created opportunities for institutional investors and alternative asset managers to expand their aviation exposure at their targeted levels of return.

New funds and institutionally-backed leasing platforms took advantage of discounted asset prices and widened credit spreads, stepping in where traditional providers of capital retrenched. Paul has worked in the finance industry since 1984, having filled numerous roles at AGC Limited (later to become part of the Westpac Group) over a number of years.

Paul joined PMG Finance in August 2000, and his expertise is in financing plant and equipment across a wide range of industries including earthmoving, agriculture, transport, aviation, mining and related services to name just a few.

Paul's vast industry experience places him in good stead to look after his clients' equipment finance needs. Boeing Capital created the Commercial Aircraft Finance Market Outlook (CAFMO) to provide an analysis of the sources of financing for new

Export Credit Agencies

commercial airplane deliveries (for aircraft 90 seats or above). Buying an aircraft typically sets you back at least $100,000. If you don't have that kind of money up front, there are several ways to finance it.

However, you might not be able to get financing to cover the cost of ownership, which can run even higher than your monthly loan repayments. When it comes to aviation loans, there are two types of lenders: those that specialize in aircraft financing and lenders that offer a range of loan products and services.

Lenders that specialize in aviation financing also typically offer other products you might need when buying an aircraft, like insurance. Finder monitors and updates our site to ensure that what we're sharing is clear, honest and current.

Our information is based on independent research and may differ from what you see from a financial institution or service provider. When comparing offers or services, verify relevant information with the institution or provider's site. Talk with a financial professional if you're not sure.

Aviation Loan

Subscribe to Plane Sales Australia to receive all our latest news and be kept up-to-date with the latest news plane listings. Rather than buying an aircraft, you can often lease it from an aircraft owner. You won't have to pay as much or be solely responsible for maintenance expenses — which can add up.

But you won't own the aircraft outright. Typically, both types of aviation loan providers use your aircraft as collateral. You can usually borrow between 70% and 100% of your aircraft's value with rates starting around 4%.

Terms typically go as long as 20 years. Aircraft lessors play an important role in the industry and are vital in maintaining a fully-functioning aircraft finance ecosystem. At the onset of the pandemic, lessors provided critical capital to airlines through sale leaseback transactions and as air traffic recovered, lessors provided airlines flexibility to adjust capacity to meet growing customer demand.

In 2021, lessors were responsible for over half of delivery financing volume. As a result, the total leased fleet grew to 47%. Anna Serio is a trusted lending expert and former Commercial Loan Officer who has written more than 1,000 articles on Finder to help Americans strengthen their financial literacy.

Aircraft Lease

A former editor of a newspaper in Beirut, Anna writes about personal, student, business and car loans. Today, digital publications like Business Insider, CNBC and the Simple Dollar feature her professional commentary. Anna earned an Expert Contributor in Finance badge from review site Best Company in 2020.

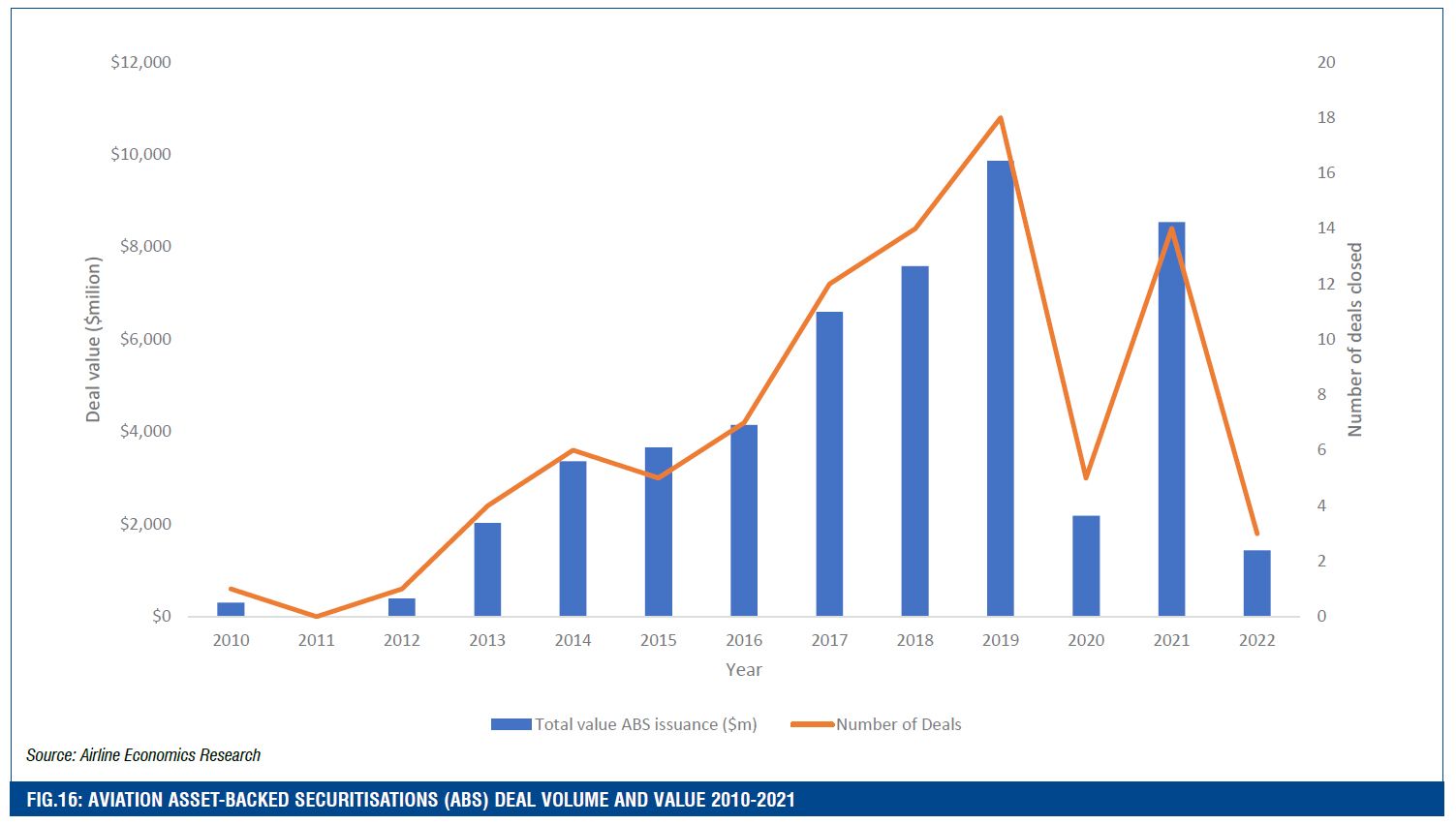

The capital markets have been a bright spot over much of the pandemic. Following the COVID-19 outbreak and an initial surge in pricing, issuers tested the capital markets in the second half of 2020 and were well-received, raising record level volumes and achieving increasingly better pricing.

In 2021, issuances stacked up comparably to the previous year's highs, flagging another year of strong performance. If you feel you have received this message incorrectly, or continue to receive this message, please note the reference number below and

send us an email at customerservice@lightstream.com. It depends on the type of aircraft you're interested in and whether you're buying new or used. Most fall into the $100,000 to $500,000 range regardless of what type you buy.

Capital Markets

However, you can find some for as little as $25,000 and upwards of $1 million. If you're considering purchasing an aircraft, you'll be in a much better position to negotiate the price if you have your finance pre-approved and know exactly what's involved in making that deal happen.

Here's where PMG Finance comes in. We're here to guide you through the entire finance process so you can concentrate on what you do best. Credit enhanced products, such as aircraft non-payment insurance, continued to be an important financing alternative.

While there were no transactions for delivery financing of Boeing aircraft in 2021, deals in the secondary market saw activity. While bank debt remains limited in the short term, credit enhanced backing may be looked upon to broaden access.

Access to tax equity financing, especially for JOL and JOLCO, is sensitive to local jurisdictions and the overall economic health of respective home markets. Tax equity investors continue to be cautious due to the pandemic, recent restructuring and ongoing litigation.

How Much Does An Aircraft Cost?

A gradual recovery in line with local economic growth and an increase in deliveries from qualified airline credits is expected. You might be able to cover part or even all of the cost with a personal loan if you're buying an aircraft — especially a smaller, used model.

Personal loans typically run from $5,000 to $50,000, although it's possible to find funding up to $100,000 through some providers like SoFi. Rates typically start around 4% APR. Truist Bank is an Equal Housing Lender. © 2020 Truist Financial Corporation.

SunTrust, Truist, LightStream, the LightStream logo, and the SunTrust logo are service marks of Truist Financial Corporation. All other trademarks are the property of their respective owners. Lending services provided by Truist Bank. Commercial bank debt for aircraft deliveries remained constrained, with varied access across regions.

Broad-based bank appetite for aviation continued to be cautious, with loans extended mainly to stronger credits and strategic customers in their respective home markets. That said, there are signs that bank debt availability is improving. Finder.com is an independent comparison platform and

Australian Aircraft Finance From Pmg Finance

information service that aims to provide you with information to help you make better decisions. We may receive payment from our affiliates for featured placement of their products or services. We may also receive payment if you click on certain links posted on our site.

national aircraft finance company, corporate aircraft finance, national aircraft finance company reviews, aircraft loan broker, aircraft finance corp, jet airplane loans jet airplane insurance, us aircraft finance, aircraft financing banks

:max_bytes(150000):strip_icc()/aircraft-insurance2-f96e49597df446d3a70054db9fa9666c.jpg)